Why Submitting an Online Tax Return in Australia Is the Fastest Means to Obtain Your Refund

Why Submitting an Online Tax Return in Australia Is the Fastest Means to Obtain Your Refund

Blog Article

Navigate Your Online Tax Obligation Return in Australia: Necessary Resources and Tips

Navigating the online tax return procedure in Australia calls for a clear understanding of your responsibilities and the sources available to enhance the experience. Crucial records, such as your Tax Obligation File Number and revenue statements, must be thoroughly prepared. Selecting an appropriate online platform can significantly affect the efficiency of your declaring procedure.

Understanding Tax Responsibilities

People must report their earnings accurately, which consists of incomes, rental income, and investment earnings, and pay taxes appropriately. Locals should comprehend the difference between taxed and non-taxable revenue to make certain compliance and optimize tax outcomes.

For businesses, tax commitments incorporate several aspects, consisting of the Item and Solutions Tax (GST), firm tax, and payroll tax obligation. It is vital for services to register for an Australian Organization Number (ABN) and, if suitable, GST registration. These responsibilities require precise record-keeping and prompt entries of income tax return.

Furthermore, taxpayers ought to be familiar with available deductions and offsets that can reduce their tax problem. Seeking suggestions from tax specialists can supply valuable understandings into maximizing tax placements while making sure compliance with the regulation. In general, a thorough understanding of tax commitments is important for reliable monetary preparation and to prevent fines connected with non-compliance in Australia.

Important Files to Prepare

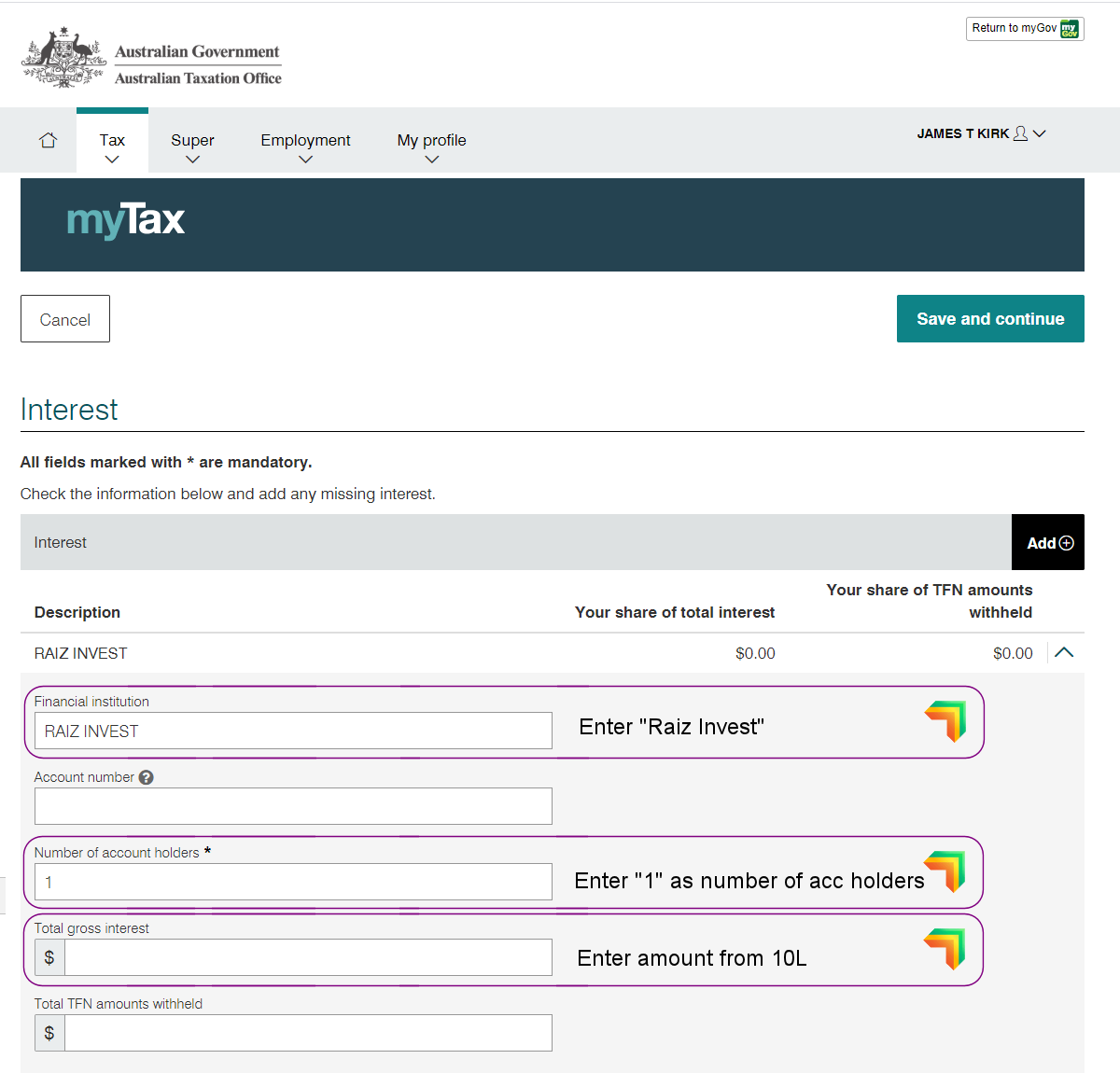

In addition, assemble any kind of appropriate bank statements that show passion revenue, as well as dividend statements if you hold shares. If you have various other income sources, such as rental homes or freelance work, ensure you have documents of these earnings and any kind of linked costs.

Take into consideration any kind of exclusive health and wellness insurance declarations, as these can impact your tax obligation obligations. By gathering these important records in development, you will certainly streamline your on the internet tax return process, minimize errors, and take full advantage of possible refunds.

Selecting the Right Online System

As you prepare to file your on the internet tax obligation return in Australia, selecting the ideal system is vital to make sure accuracy and convenience of usage. Numerous crucial variables ought to direct your decision-making procedure. Consider the system's customer interface. An uncomplicated, user-friendly design can substantially enhance your experience, making it simpler to browse intricate tax return.

Following, assess the platform's compatibility with your monetary scenario. Some services provide specifically to individuals with simple tax obligation returns, while others offer thorough assistance for extra intricate situations, such as self-employment or investment earnings. Look for systems that offer real-time mistake monitoring and guidance, helping to reduce errors and guaranteeing compliance with Australian tax legislations.

Another vital facet to think about is the level of customer assistance available. Dependable systems must supply access to aid via e-mail, phone, or conversation, particularly during peak filing durations. Additionally, research user evaluations and ratings to evaluate the overall fulfillment and integrity of the system.

Tips for a Smooth Filing Refine

Filing your online income tax return can be a simple procedure if you comply with a couple of crucial tips to make certain effectiveness and precision. Gather all necessary papers prior to starting. This includes your revenue statements, invoices for deductions, and any kind of other pertinent paperwork. Having every little thing at hand lessens mistakes and interruptions.

Next, benefit from the pre-filling attribute provided by lots of on the internet platforms. This can conserve time and lower the possibility of blunders by automatically inhabiting your return with info from previous years and data given by your employer and economic institutions.

Furthermore, ascertain all access for precision. online tax return in Australia. Mistakes can lead to delayed refunds or issues with have a peek here the Australian Taxation Workplace (ATO) See to it that your personal information, income numbers, and deductions are appropriate

Bear in mind deadlines. If you owe tax obligations, filing early not only decreases tension but also permits more helpful hints for far better preparation. Lastly, if you have concerns or uncertainties, get in touch with the assistance areas of your selected system or look for specialist suggestions. By complying with these tips, you can browse the on-line tax return process efficiently and confidently.

Resources for Assistance and Support

Navigating the complexities of on the internet income tax return can in some cases be complicated, yet a range of resources for assistance and assistance are readily available to help taxpayers. The Australian Tax Workplace (ATO) is the main source of information, using extensive guides on its site, including Frequently asked questions, instructional video clips, and live conversation choices for real-time aid.

Additionally, the ATO's phone assistance line is readily available for those who like direct communication. online tax return in Australia. Tax specialists, such as registered tax representatives, can also offer personalized assistance and make certain conformity with current tax guidelines

Verdict

Finally, effectively navigating the online income tax return process in Australia needs an extensive understanding useful reference of tax obligation responsibilities, thorough prep work of vital papers, and careful option of an ideal online system. Following sensible pointers can enhance the declaring experience, while offered resources use useful help. By approaching the process with persistance and focus to information, taxpayers can make sure compliance and optimize prospective benefits, ultimately adding to an extra effective and successful income tax return end result.

As you prepare to submit your on the internet tax obligation return in Australia, choosing the best system is vital to guarantee precision and simplicity of use.In final thought, effectively browsing the on the internet tax return procedure in Australia requires a comprehensive understanding of tax obligations, meticulous prep work of important records, and mindful choice of a proper online platform.

Report this page